Finly

Financial Literacy & Management App

Finly is my design certificate degree project at MassArt. Throughout the fall 2021 semester I conducted research on gen z’s relationship with money. I wanted to get an understanding of what they know, what they don’t, and what they should know about money management as they approach graduation and financial independence.

If you are interested in reading about the discovery/research phase of this project, check out a summary PDF here.

Stay tuned for updates! I’m revisiting this project in my spare time (3/8/24)

The Problem

Gen Z’ers are stressed out! They understand the importance of financial wellness & they’re looking for tech-based solutions for money management. This is the driving force behind my project.

https://www.prnewswire.com/news-releases/gen-z-and-money-will-the-youngest-generation-of-adults-drive-fintech-300929738.html

The User

The beginning of the semester is all about dialing into my specific problem and opportunity space. I began by making sure I had a clear picture of my target user in mind as I moved forward.

Direction

With my user in mind, I created a statement of purpose to give myself a guidepost to return back to in moments of doubt as I begin ideating possible solutions. This statement has changed many times and may change again as I further specify my users problems and identify achievable opportunities for innovation.

Ideation Phase 01

Nearing the end of the primary research phase, I found various analogous digital experiences I wanted to break down and reference as I moved towards preliminary concept generation. These ideas highlight the benefit provided to the user and utilize placeholder reference imagery from those analogous experiences. For each concept, I also called out which experience objective(s) it primarily focuses on.

Concept 01

This first concept uses screens from both Duolingo and Realworld as self-directed learning platforms. ‘Finlingo’ is an amalgamation of the two that balances the gamification of Duolingo with the educational playbooks of Realworld.

Concept 02

‘Finstar’ takes a financial spin on Co-star the horoscope app. The idea of the personalized within Co-star and wanted to conceptualize how that quality might enhance financial education.

Concept 03

I was really inspired by Quivervision, which is an AR app that utilizes coloring pages and worksheets to enable interactive experiences. With ‘Finvision’ I wanted to think about how the user could benefit from interacting with their money in a pseudo-physical way, hoping to provide tangibility to the intangible concept of digital currency/savings accounts/credit cards etc.

Concept 04

In a more traditional approach, Findash takes cues from financial analysis tools and budgeting platforms like Mint.

Concept 05

Trying to break out of traditional thinking, Finpet references the Tamogachi play pattern. I thought it would be interesting to provide a phygital experience that allows the user to learn about financial best practices through the act of caring for a virtual companion.

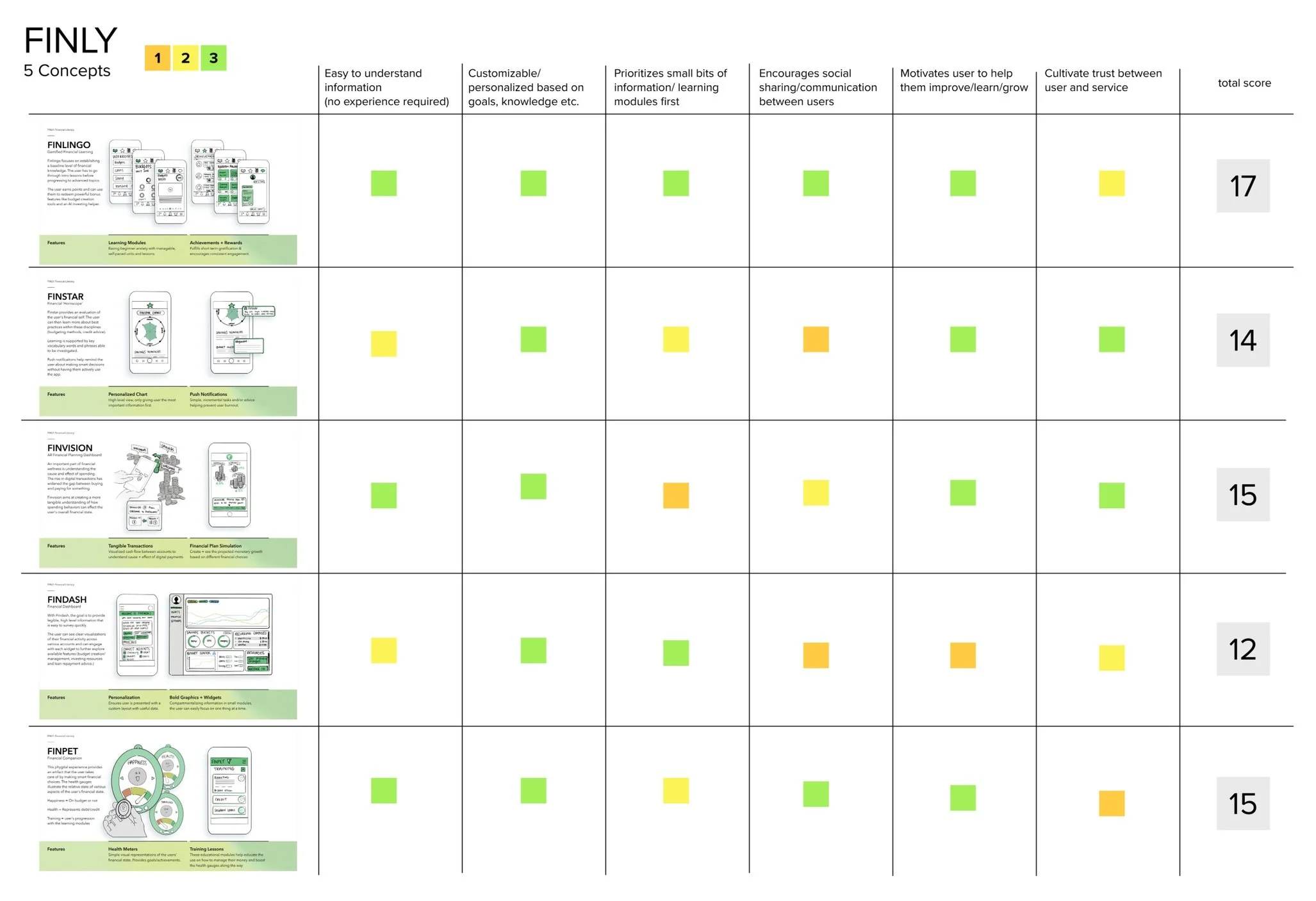

Concept Evaluation

I scored my concepts against the product attributes I outlined earlier in the process in order to help me identify which could best solve my user’s needs.

Market Opportunity

Since there are so many fintech products on the market, I wanted to do some research and find out what they do and don’t offer. This way I could position Finly to become a one stop shop for all of the user’s financial needs.

Experience Objectives

With concept 1 coming out on top from the first concept phase, I wanted to create a short list of objectives to focus on as I work through developing the financial education platform. These would help me to make sure I keep the wholistic experience and goals in mind.

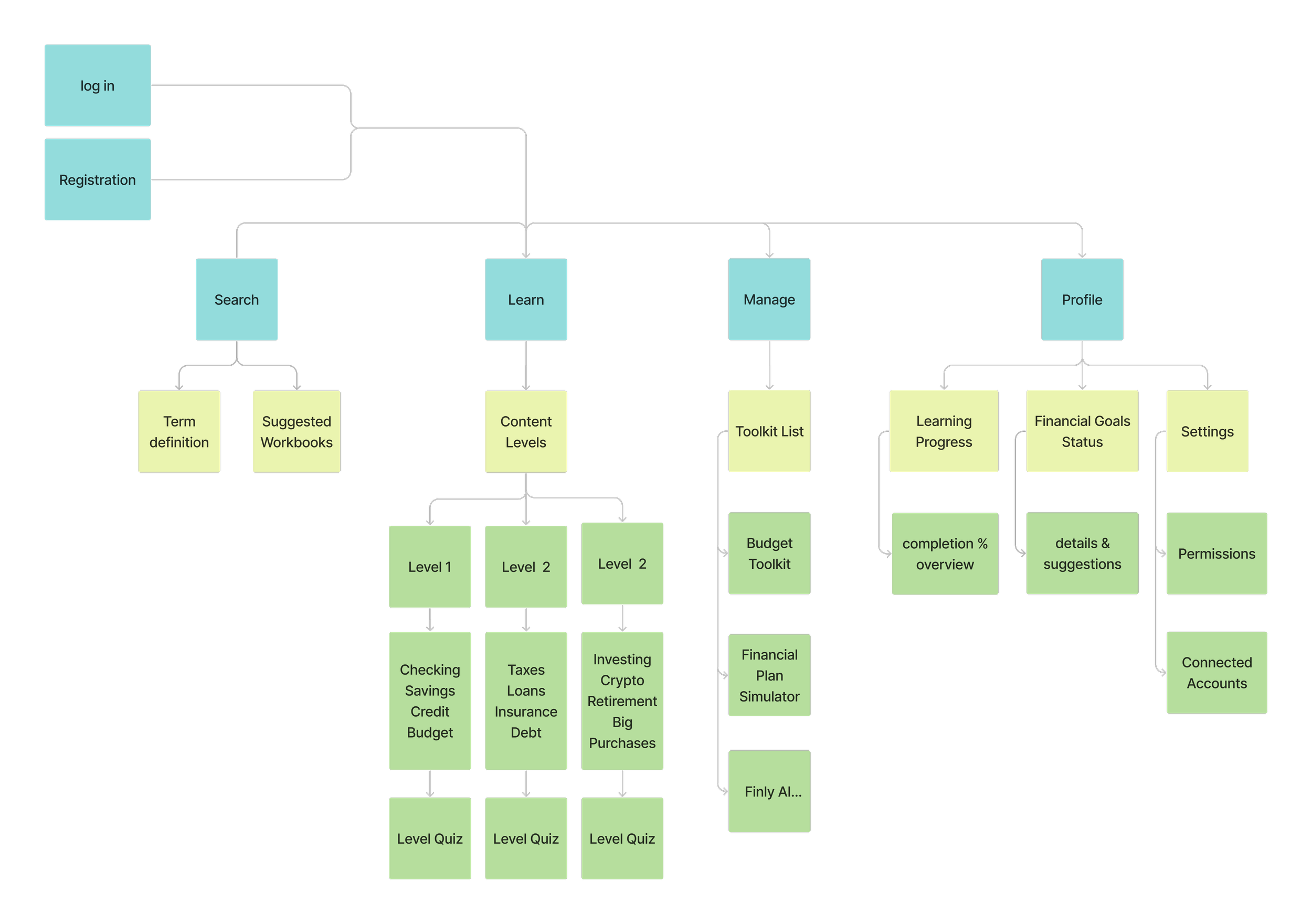

User Flows & Site Maps

My next step was to map out my user flow and overall site structure and make sure it aligns with my experience objectives.

If you’re curious about the details, view PDF of user flow + site map here.

High level User Flow

Site Map

Wireframing & Usability Testing!

LEARN

This section revolves around the user progressing through a series of topics to gain experience points that lead up to unlocking their first interactive toolkit. In Level 1 the user is learning about various types of financial basics like credit, budgeting, and checking vs savings accounts. The lessons are filled with short videos supported by text descriptions and other key info like important term definitions. The core user responds well to short bites of information rather than long form video lectures so they can get to the core of the lesson as quickly as possible.

MANAGE

Once the user has completed all the lessons within Level 1 they will have accumulated enough experience points to unlock their first Tool Kit. For Level 1, that would be the Budget Tool Kit. Within this interactive module, the user can connect their various cards/financial accounts, and Finly will generate a synopsis of their spending activity. The user can also input financial goals and Finly will help generate savings goals and spending category limits to help support those objectives.